The Impact of Seller’s Stamp Duty (SSD) & Additional Buyer’s Stamp Duty (ABSD) and How it Benefits Singapore Property Market

This article aims to enlighten property investors or buyers in Singapore with regards to stamp duties, and what are the impacts of Seller's Stamp Duty (SSD) and Additional's Buyer Stamp Duty (ABSD) with their benefits to the Singapore property market.

Stamp Duty for Singapore Property Defined:

For us to have a clear view and understanding of this article subject – it would be wise of us to define what is stamp duty on property. Generally - Stamp duty is a tax on official papers linking to the buying or leasing of a residential, commercial or industrial property.

When is stamp duty payable in Singapore?

This is to be paid by the purchaser or lessee in a period within fourteen days after the date of signed documents such as Sale & Purchase Agreement (SPA), Option to Purchase (OTP) or Tenancy Agreement - if the document is contracted in Singapore. But if the papers are contracted overseas, it would have to be paid within thirty days after date of its reception in Singapore. Note also that only a signed set of paper (documents) which has a stamp duty paid is admissible as evidence in court in cases of discrepancies.

Okay we have the basics of what a stamp duty is; now let us further look into its unique variants.

This type of stamp duty is tax remitted on the receipt of Option to Purchase (OTP) or Sale & Purchase Agreement (SPA). These official papers are the documents that are organized and signed when you purchase your property. The Buyer’s Stamp Duty is payable on the exact purchase price or market valuation, whichever is higher. The purchaser is liable for paying Buyer’s Stamp Duty, and wherever a property is sold within the minimum holding period, the seller is accountable for paying Seller’s Stamp Duty.

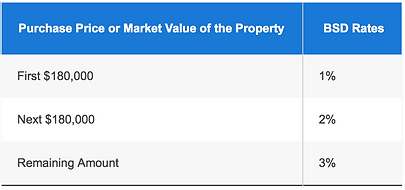

The Rates and Computation for Buyer’s Stamp Duty is as below:

BSD is computed based on the purchase price or market value of the property, whichever is higher.

What is the Additional Buyer’s Stamp Duty?

Additional Buyer’s Stamp Duty in short (ABSD) – is a stamp duty first announced on 8 December 2011 and further revised upwards on 12 January 2013 due to rapid property price escalation in the domestic residential market. It is a series of property cooling measures implemented by Singapore government to cool off the overheated market. Additional Buyer’s Stamp Duty (ABSD) is to be paid by certain groups of individuals that purchase residential properties on top of the prevailing buyer’s stamp duty (BSD), and is valid as below:

Singapore MRT Map in early 90s

** Additional buyer stamp duty exemption applies to Singapore citizen on their first property purchase.

Let’s assume a foreigner purchasing a property at a market value price of $2 million. The ABSD rate of 15% will apply to this particular buyer

The Seller’s Stamp Duty (SSD) in Singapore

On 20th February 2010, the Singaporean government implemented the Seller’s Stamp Duty (SSD) for sales of residential property. Such transaction of a residential property within the first year of ownership draws a stamp duty payable by the seller.

The measurement had been further tweaked on 30th August 2010. For the transaction of a residential property within the second year of possession, the stamp duty payable by the seller will be two third of the full SSD rate. Furthermore, for residential property sold within third year of proprietorship, the stamp duty payable by the seller will be one third of the full Seller’s Stamp Duty rate.

Despite these two cooling measures, the prices of residential properties did not stabilize but continue to surge upward. Hence on 14th Jan 2011, the government announced the third round of cooling measures on SSD. The holding period has been increased to 4 years and the rates chargeable are changed to 16%, 12%, 8% and 4% of the total sales price on the first, second, third and fourth year respectively.

The appropriate date for use to compute the SSD period is the date of exercise of the Option to Purchase (OTP), or in absence of an Option, the date of the SPA i.e. Sale & Purchase Agreement.

The Impact of Increased Seller Stamp Duty Period

SSD was setup to control the overheated residential property market in the past. It is evidently directed at property investors who take benefit of short-term gains in the residential property market. And with this now as a cooling measure, speculators are now discouraged from going into the property market for short-term advantages. In specific terms, investors purchasing new launch condo under development with anticipation of marketing at higher prices upon issuance of TOP will have to pay SSD since most new launches are projected to get their respective TOP in less than 3 years.

The augmented Seller’s Stamp Duty holding period might unfairly impact sellers who are not speculators but who have good motives such as personal reasons to sell their residential property within less than four year’s tenure which is actually not a short time structure.

Determining SSD’s liability, whether it is payable and its rate will be dependent on:

-

The kind of property acquired or disposed

-

The date of acquisition

-

The date of transaction or disposal

NB: Where land is traded with prevailing building, the liability for seller stamp duty SSD will be centered on the zoning of the land in the Master Plan. And for non-residential property that the endorsed use is changed to residential, the date of procurement of the property will be the timing of rezoning or the change of use. Selling’s Stamp Duty is calculated by applying the obligatory SSD rate on the sales price or the market worth of the property as at the date of sale or disposal, whichever is greater.

On point with the additional buyer's stamp duty (ABSD) – the fraction of a home's value that a buyer can loan, known as the loan-to-value (LTV) ratio, is already slashed to as low as twenty per cent for certain buyers who have more than one existing residential loan. The minimum down payment for some purchasers is also increased to twenty five percent. These cooling measures affect those with at least one housing loan.

The Benefits of ABSD and SSD

In general, the implementation of ABSD and SSD is to help Singaporean buy their first home, which is the Government's principal goal, and to safeguard all property owners from a steep price correction (hard landing) down the road. Typically, the basis for seller’s stamp duty and additional buyer’s stamp duty for the Singapore property market is to put a limit and check on the sky-high prices and rental in recent years that have sent property and business costs spiraling.

In industrial property sector, the goal is to discourage short-term speculation that could interfere property prices and raise business costs. This is for the benefits of assisting small and medium enterprise (SME) companies and also to prevent a rise in industrial property prices. Genuine buyers appreciate and understand the logic on Seller’s Stamp Duty on industry property, as it is geared at lowering the costs for business owners and deliver some saneness to the whole industrial market.

ABSD Remission

Some married couples will be granted ABSD reimbursement if they dispose of their first property within 6 months of purchasing a resale home or the completion of an uncompleted project. Such reimbursement is delivered for joint purchases by married couples with at least one Singaporean. The two parties must also not possess any other property at the time of purchase to be eligible. However, it does not extend to singles, meaning singles will have to dispose their existing home first before purchasing the next residential property - even if the next purchase is intended for own stay and not investment.

Singapore is a safe haven for property investments as it is a vibrant market and investors across Asia know and trusts its political stability. The low interest charges might have played their role in pushing property prices high, in spite of the exertions of the Monetary Authority of Singapore (MAS) and the government. And the overall benefits of Seller’s Stamp Duty and Additional Buyer’s Stamp Duty is evident to the home purchasers’ or investors’ advantage in stabilizing the housing market.

See more: Remission of ABSD for Married Couples (Source: IRAS)